How to Shop for a Car Loan

9 tips for getting a low interest rate on a new- or used-auto loan, whether your credit is great or just so-so

Whether you’re a paragon of virtue when it comes to your credit—or not—a recent Consumer Reports investigation into car loans found that the interest rate you’re offered can depend on how prepared for battle you are. Here’s how to get yourself in the best position when borrowing for a car, so you can be sure that you’re offered fair terms and that you don’t bite off more than you can afford.

Here’s what experts advise.

Review Your Credit Report and Credit Score

While CR’s analysis found that even people with good credit scores can sometimes get pricey loans, in general, the higher your score, the lower your rate. That’s because a good score, which is based on your history of paying bills and debts, can indicate to lenders that you are less of a risk.

Improve Your Score

This is especially important if you’ve had credit problems in the past. Sometimes improving a low score is as simple as correcting mistakes or discrepancies in your credit report. Most mistakes and disputes are completed in 10 to 14 days, Takeyama says, and credit reporting agencies generally must complete their investigations within 30 days. Paying down existing debt and late bills can also give you a last-minute bump. As always, pay bills for credit cards, utilities, and other goods promptly to avoid late fees and further damage to your credit score.

Set a Budget and Stick to It

Dealer sales staff can be masters of the upsell. Consider your needs today and how they may evolve over the ownership period. Resist the urge to indulge in extras or to buy a bigger or fancier vehicle than you need, because you’re likely to be paying on that depreciating asset for years to come.

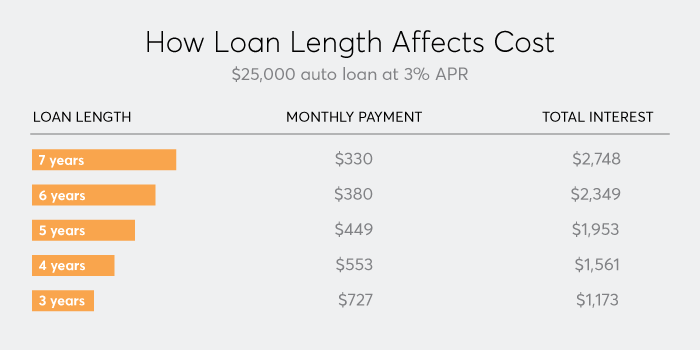

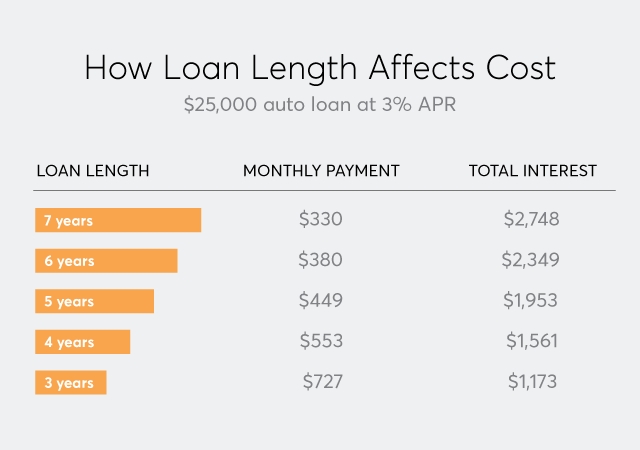

Don't Focus on Just the Monthly Cost

Dealers often try to sell you on a loan by emphasizing what you will have to pay each month. And that does matter, of course, for budgeting purposes. But to get low monthly payments you will probably need to extend the loan out for long periods of time, which can increase its overall cost. Another downside to a long-term loan: That increases the chance that you will end up “underwater” or “upside down” on your loan, which is when you owe more on the car than what it’s worth. Of course, a monthly cost that you can handle is important, too, so it’s important that you consider both factors when choosing a loan.

Make the Biggest Down Payment You Can

That shortens the loan, says Alain Nana-Sinkam, vice president of lending and insurance solutions at TrueCar, a CR partner that analyzes market trends. Putting down more money up front also means you’ll be paying interest on a smaller amount of money, costing you less overall. CR recommends trying to put down at least 15 percent of the car’s value.

Get Preapproval From Your Bank

Before you set foot in a dealership—either physically or virtually—contact your bank or credit union and get preapproved for a loan. The dealer may be able to offer a better deal on financing, but having a loan secured ahead of time gives you a strong starting point for negotiations.

If Your Credit Isn't Great, Check Carmakers for Special Deals

Some automakers, including Chrysler, Hyundai, Kia, Mitsubishi, and Nissan, offer financing for subprime borrowers, although it is usually focused on entry-level and economy cars.

Consider Buying a Used Car

Newer used vehicles are unusually expensive right now, but money can be saved by buying an older model. Although interest rates tend to be higher on loans for used cars, lowering the amount you’re borrowing can result in significant savings. But do watch out: Interest rates can be higher some used car lots, especially so-called ’buy-here, pay-here" dealerships, according to a research from the Consumer Financial Protection Board.

Stop Overcharging for Car Loans!

Sign CR’s petition to the Consumer Financial Protection Bureau to ensure that auto loans are fairly priced.

Report Suspected Discrimination

Black and Hispanic borrowers with the same creditworthiness as white ones pay almost 1 percentage point more interest on car loans, according to a 2021 study. The study also found that borrowers of color were slightly more likely to be denied a loan outright. This is how they mark up loans for profit, and as outlined in the study, how dealers were able to charge minority borrowers more. If you suspect discriminatory lending, file a complaint with the Consumer Financial Protection Bureau or with the Federal Trade Commission.